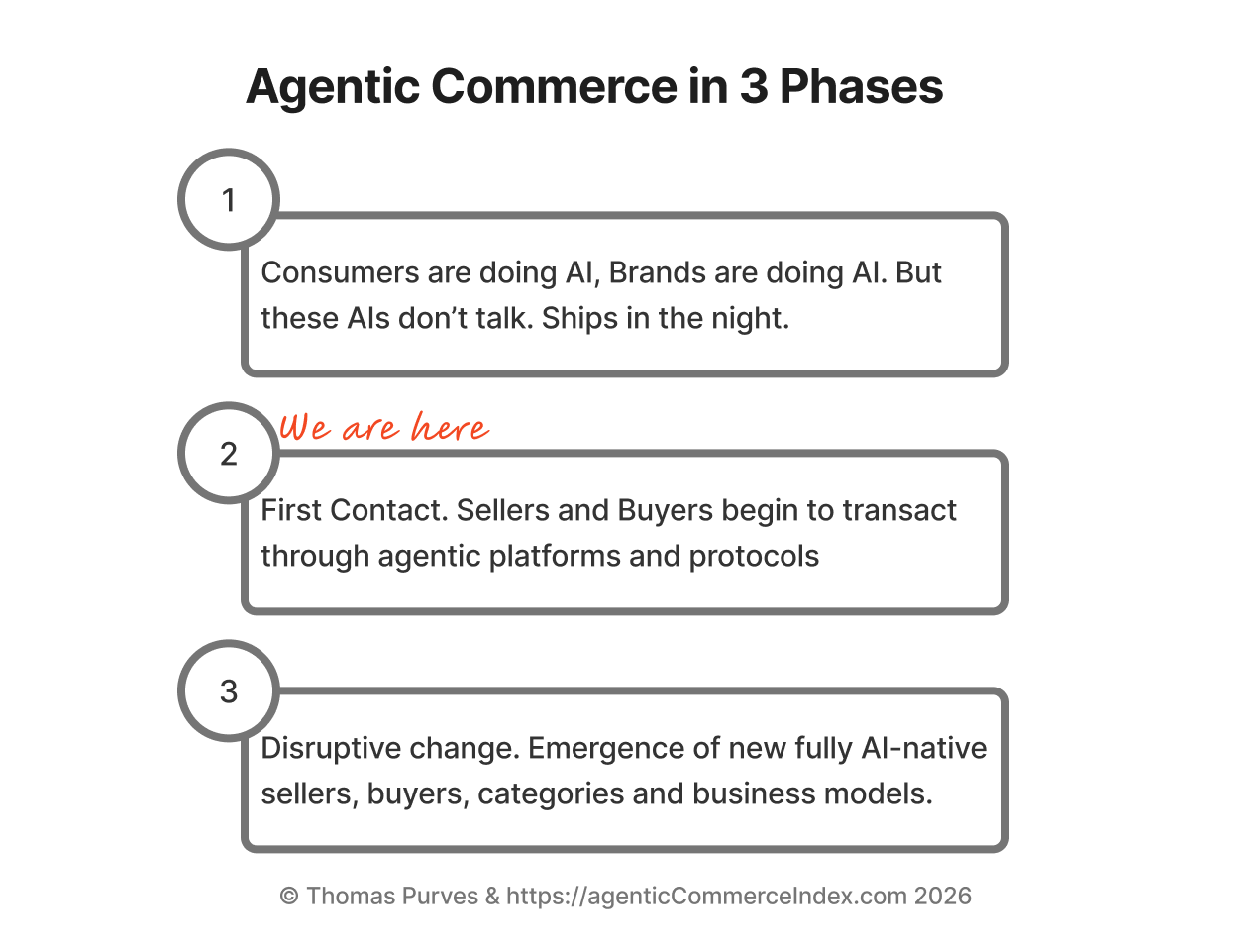

1. Ships in the Night:

consumers mass-adopt AI, merchants too mass adopt AI. But these AI usecases don’t talk to each other. 55% of consumers this holiday season used AI to help them with shopping for search, product recommendations etc. But all ending up checking out on a traditional website. Brands meanwhile have gone ham on AI for marketing content, ops/customer service automation etc. But all this AI for connecting with traditional humans.

2. The Transition Era.

Think of ‘first contact’ between a customer’s preferred AI and the merchant’s AI. We’re still talking about selling the same kinds of widgets to the same kind of customers. However,this time the journey connects end-to-end from the consumer’s starting AI surface straight through to completed purchase. Even for the simplest possible categories of purchases or baskets.

Key to this phase is any generous definition of merchant being ‘AI ready’. Where merchant has (intentionally) exposed any machine-friendly interface that bots can work with. AI’s clumsily controlling the users browser to click through web UIs doesn’t count. First-party AIs where the merchant offers it’s own shopping chatbot doesn’t really count either (although that’s a whole strategy too). Getting to this phase is the main battleground over the last year amongst the tech giants, with several competing technologies and protocols for Agentic Commerce being bandied about.

Now, don’t underestimate the grind of phase 2. Horizontally scaling any new acceptance technology can literally take decades. But there will be some breakout successes and niche early winners. Which brings us to…

3. Disruption by new AI-native business models.

You couldn’t have had Amazon, Ebay or Netflix without the original internet. You couldn’t have had Uber, Tinder, Robinhood without mobile. Similarly, the new modalities and possibilities of AI to AI interactions will allow whole new value propositions while removing old operating constraints and assumptions. Here’s one example: today it’s often better to leave some money on the table in the interest of product and pricing simplicity. Good better best, and simple to explain pricing are sensible constraints when you have to work around the cognitive load of human buyers or human sales staff. AIs don’t have these same constraints. Instead imagine much more granular and flexible product bundling, feature selection and then pricing negotiation optimizing for how much to pay and when to pay, dynamically optimized by individual buyer and sellers’ rational but individualistic preference curve for value now vs value later vs trust & risk tolerance etc.

Crucial to this particular vision though, is one important but non-trivial assumption. That each side to an Agentic Commerce transaction has some agent that they feel they can trust with their private information to be aligned to their best interests.